Health

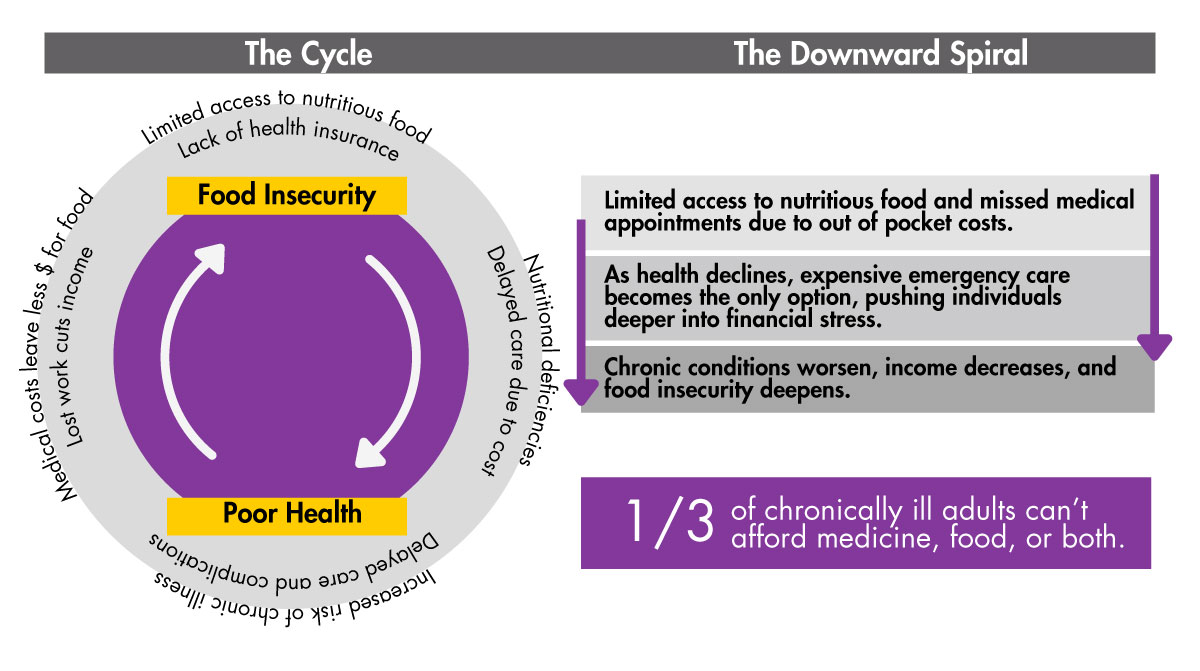

A worsening health condition or sudden medical emergency can set off a chain reaction which reinforces food insecurity – as medical expenses climb and hourly workers lose wages, exacerbating their financial insecurity and that of their employers.

Health

A decline in person health, or that of a child or parent, or a sudden medical emergency can set off a chain reaction which reinforces food insecurity – as medical expenses climb and hourly workers lose wages, worsening their financial insecurity and that of their employers.

Food Insecurity Perpetuated by Lack of Healthcare Access.

Families experiencing food insecurity face a higher risk of poor health outcomes, including a greater prevalence of chronic conditions like diabetes, hypertension, and heart disease.

These families frequently live in neighborhoods with fewer health care resources, face greater exposure to environmental health hazards, and work in jobs without health insurance or paid sick leave.

Barriers to Nutrition and Healthcare

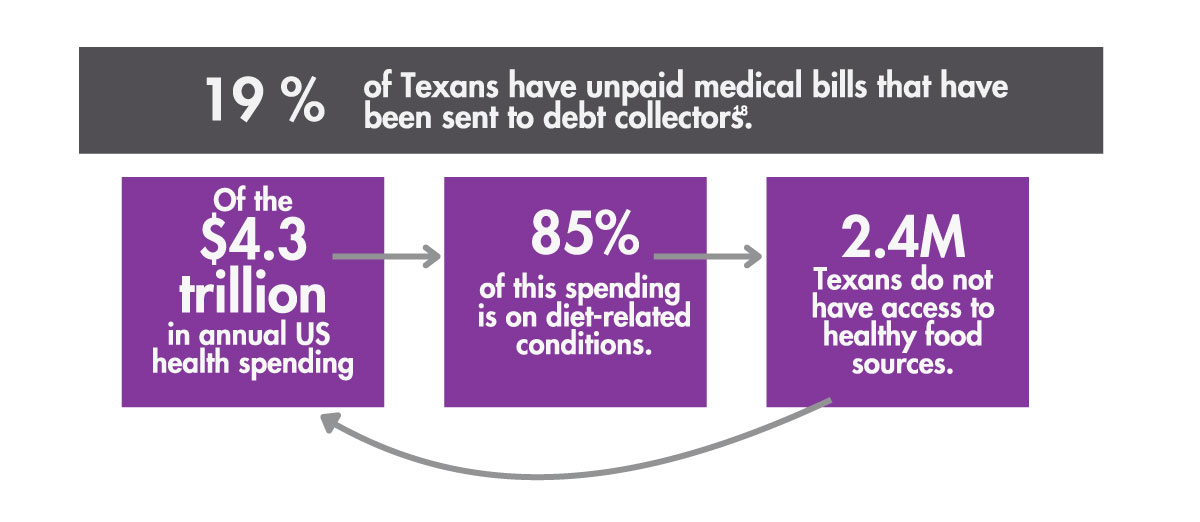

Texas, has some of the highest rates of food insecurity paired with some of the highest rates of uninsured individuals and diet-related diseases. Nearly 5 million Texans — double the national average — lack health insurance, and over 2 million Texas households are food insecure. These combined challenges lead to a cycle of worsening health and financial strain.

The Ripple Effect

When families are forced to wait for a medical emergency due to lack of coverage or funds, they face medical debt and lost wages, while hospitals are burdened by uncompensated care. This debt has a ripple effect on many areas, including:

To break the cycle of poor health and food insecurity, solutions must simultaneously prioritize reduction of healthcare costs while promoting preventative care and better nutrition access.

Policy Roadmap

Sources

- National Institute on Minority Health and Health Disparities. (2024). Food Accessibility, Insecurity, and Health Outcomes. https://www.nimhd.nih.gov/resources/understanding-health-disparities/food-accessibility-insecurity-and-health-outcomes.html

- Gregory, C. A., & Coleman-Jensen, A. (2017). Food insecurity, chronic disease, and health among working-age adults (Economic Research ReportNo. 235). U.S. Department of Agriculture, Economic Research Service. https://www.ers.usda.gov/webdocs/publications/84467/err-235.pdf?v=4205.2

- Sonik, R. A. (2019). Health insurance and food insecurity: Sparking a potential virtuous cycle. American Journal of Public Health, 109(9), 1163–1165. https://doi.org/10.2105/AJPH.2019.305252

- Dean, E. B., French, M. T., & Mortensen, K. (2020). Food insecurity, health care utilization, and health care expenditures. Health Services Research,55(Suppl 2), 883–893. https://doi.org/10.1111/1475-6773.13283

- Hanson, K. L., & Connor, L. M. (2014). Food insecurity and dietary quality in US adults and children: A systematic review. The American Journal ofClinical Nutrition, 100(2), 684–692. https://doi.org/10.3945/ajcn.114.084525

- Sun, Y., Liu, B., Rong, S., Du, Y., Xu, G., Snetselaar, L. G., Wallace, R. B., & Bao, W. (2020). Food insecurity is associated with cardiovascular andall‐cause mortality among adults in the United States. Journal of the American Heart Association, 9(19), e014629. https://doi.org/10.1161/JAHA.119.014629

- Himmelstein, D. U., Dickman, S. L., McCormick, D., Bor, D. H., Gaffney, A., & Woolhandler, S. (2022). Prevalence and risk factors for medical debtand subsequent changes in social determinants of health in the US. JAMA Network Open, 5(9), e2231898. https://doi.org/10.1001/jamanetworkopen.2022.31898

- Boone-Heinonen, J., Evenson, K. R., Song, Y., & Gordon-Larsen, P. (2010). Built and socioeconomic environments: Patterns and associations withphysical activity in US adolescents. International Journal of Behavioral Nutrition and Physical Activity, 7(1), 45. https://doi.org/10.1186/1479-5868-7-45

- Centers for Medicare & Medicaid Services. (2022). National health care spending in 2021: Decline in federal spending outweighs greater use of healthcare. Health Affairs. https://doi.org/10.1377/hlthaff.2022.01397

- Texas Health and Human Services. (2023). Data Brief: Food insecurity in Texas and Texas Legislative Districts. https://sph.uth.edu/research/centers/dell/legislative-initiatives/data-brief-food-insecurity-in-texas-and-texas-legislative-districts

- U.S. Census Bureau. (2022). American Community Survey 1-year Estimates. https://www.census.gov/programs-surveys/acs

- Rabbitt, M. P., Reed-Jones, M., Hales, L. J., & Burke, M. P. (2024). Household food security in the United States in 2023 (Report No. ERR-337). U.S.Department of Agriculture, Economic Research Service. https://doi.org/10.32747/2024.8583175.ers

- Berkowitz, S. A., Seligman, H. K., & Choudhry, N. K. (2014). Treat or eat: Food insecurity, cost-related medication underuse, and unmet needs. TheAmerican Journal of Medicine, 127(4), 303-310.e3. https://doi.org/10.1016/j.amjmed.2014.01.002

- Board of Governors of the Federal Reserve System. (n.d.). Credit Reports and Credit Scores. https://www.federalreserve.gov/creditreports/pdf/credit_reports_scores_2.pdf

- National Association of Professional Background Screeners & HR.com. (2017). National Survey: Employers Universally Using BackgroundScreenings to Protect Employees, Customers and the Public. https://www.napbs.com/background-screening-research-2017.pdf

- The Aspen Institute. (2018). Consumer Debt: A Primer. https://www.aspeninstitute.org/publications/consumer-debt-primer/

- Dobbie, W., Goldsmith-Pinkham, P., Mahoney, N., & Song, J. (2017). Bad credit, no problem? Credit and labor market consequences of bad creditreports (Staff Report No. 795). Federal Reserve Bank of New York. https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr795.pdf

- Urban Institute. (2024). Debt in America: An Interactive Map (Data from August 2023). http://urbn.is/2AnVzHa